Examine Economic Consequences of using a Loan vs. an Income Share Agreement

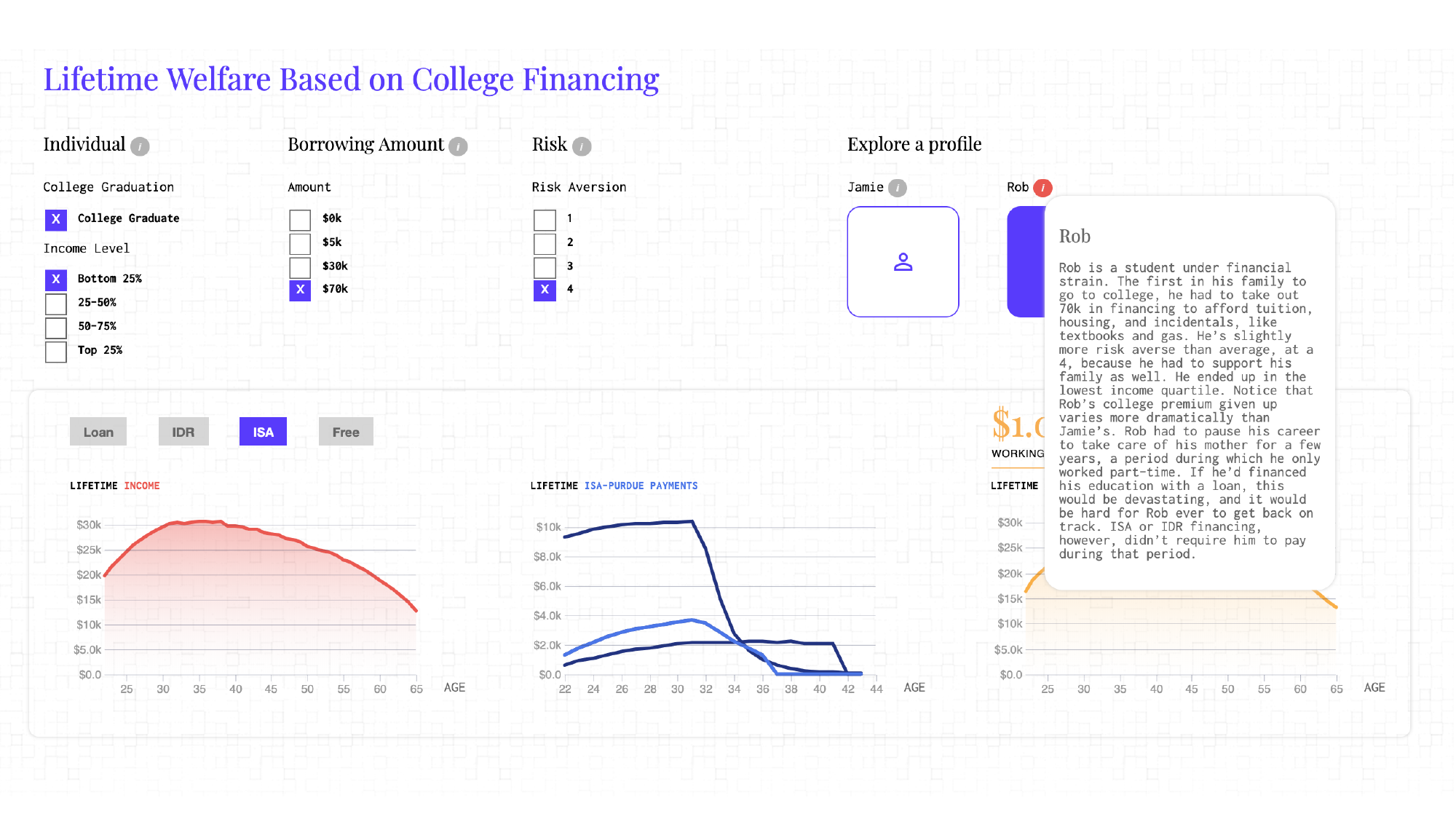

The Jain Family Institute is a think tank that designs and implements social initiatives such as Universal Basic Income and Income Share Agreements. For this web app, the goal was to use their data models to show the difference in lifetime income, payments and consumption using different borrowing instruments. Primarily, the economic consequences of taking out a loan instead of an income-share agreement to fund college for the lowest income earners.

About the Data (Collected and Visualized)

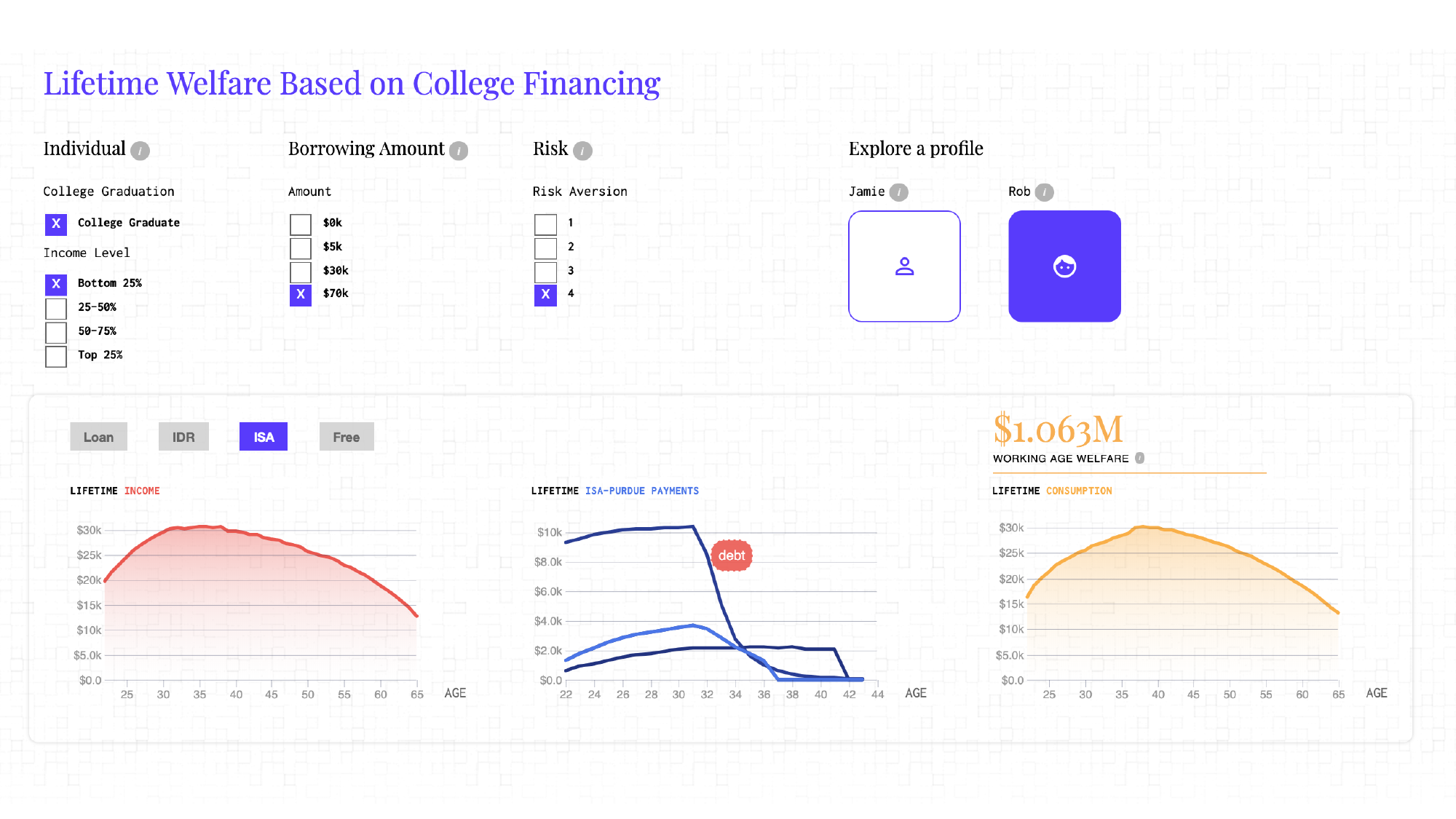

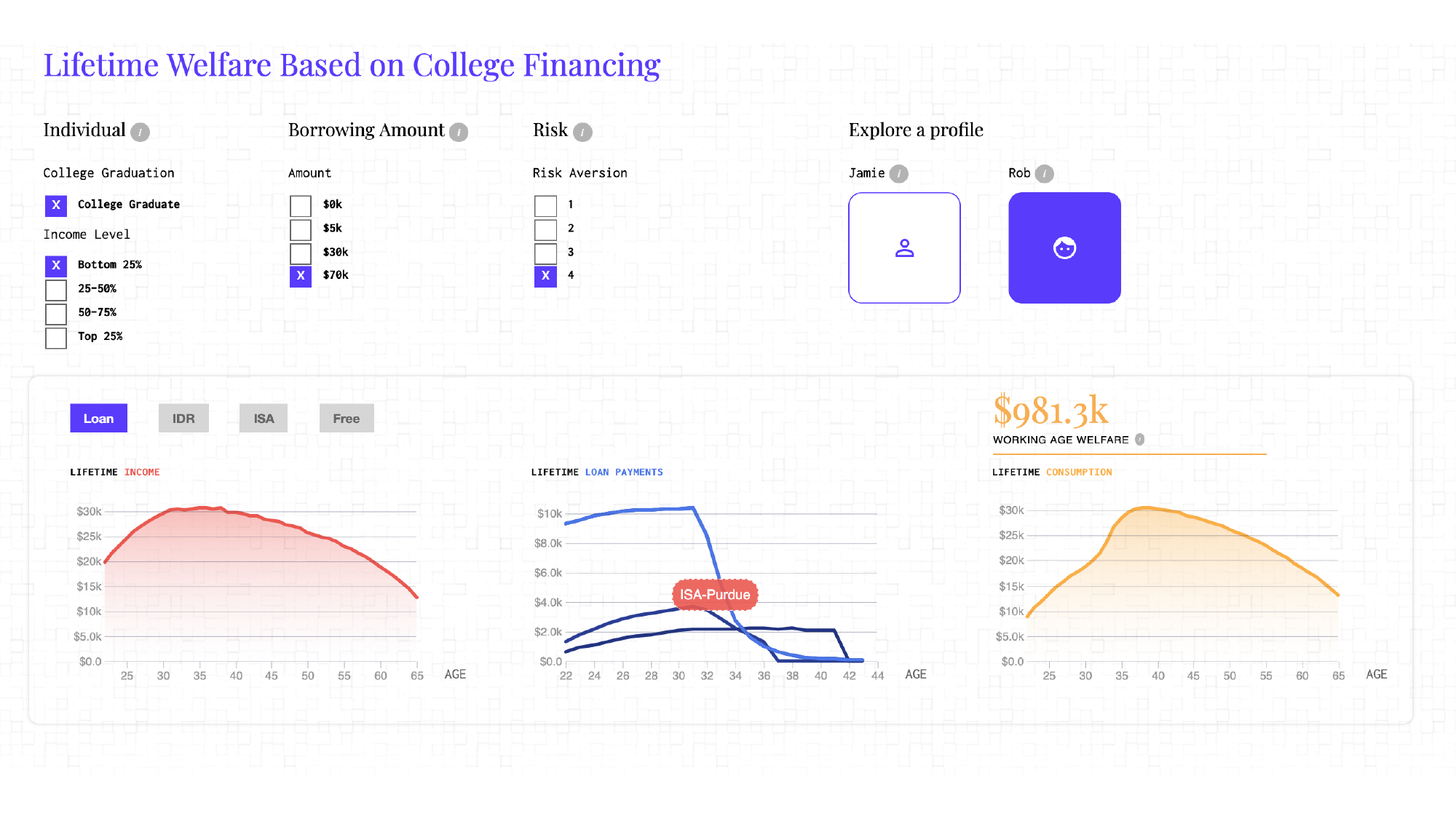

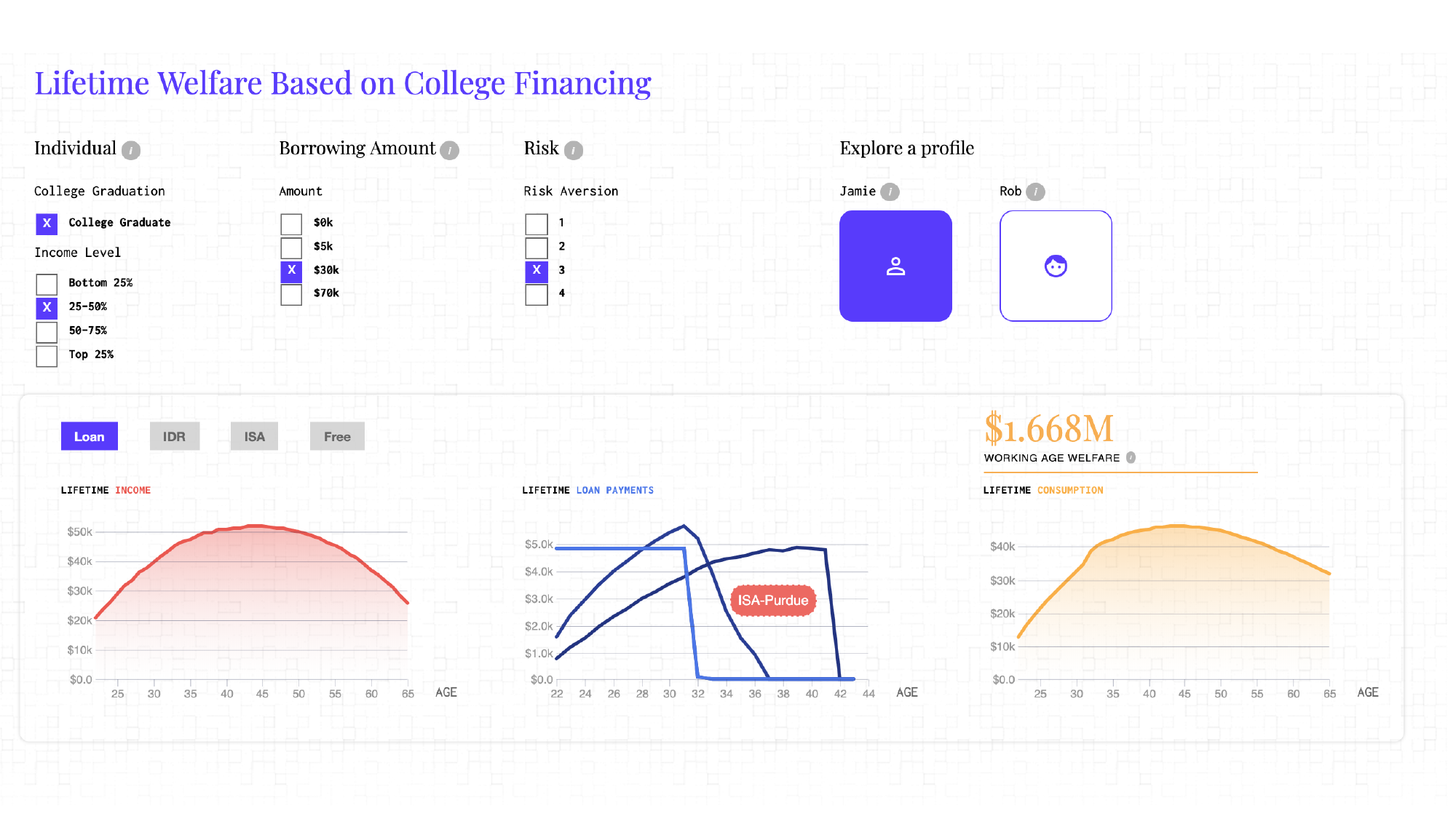

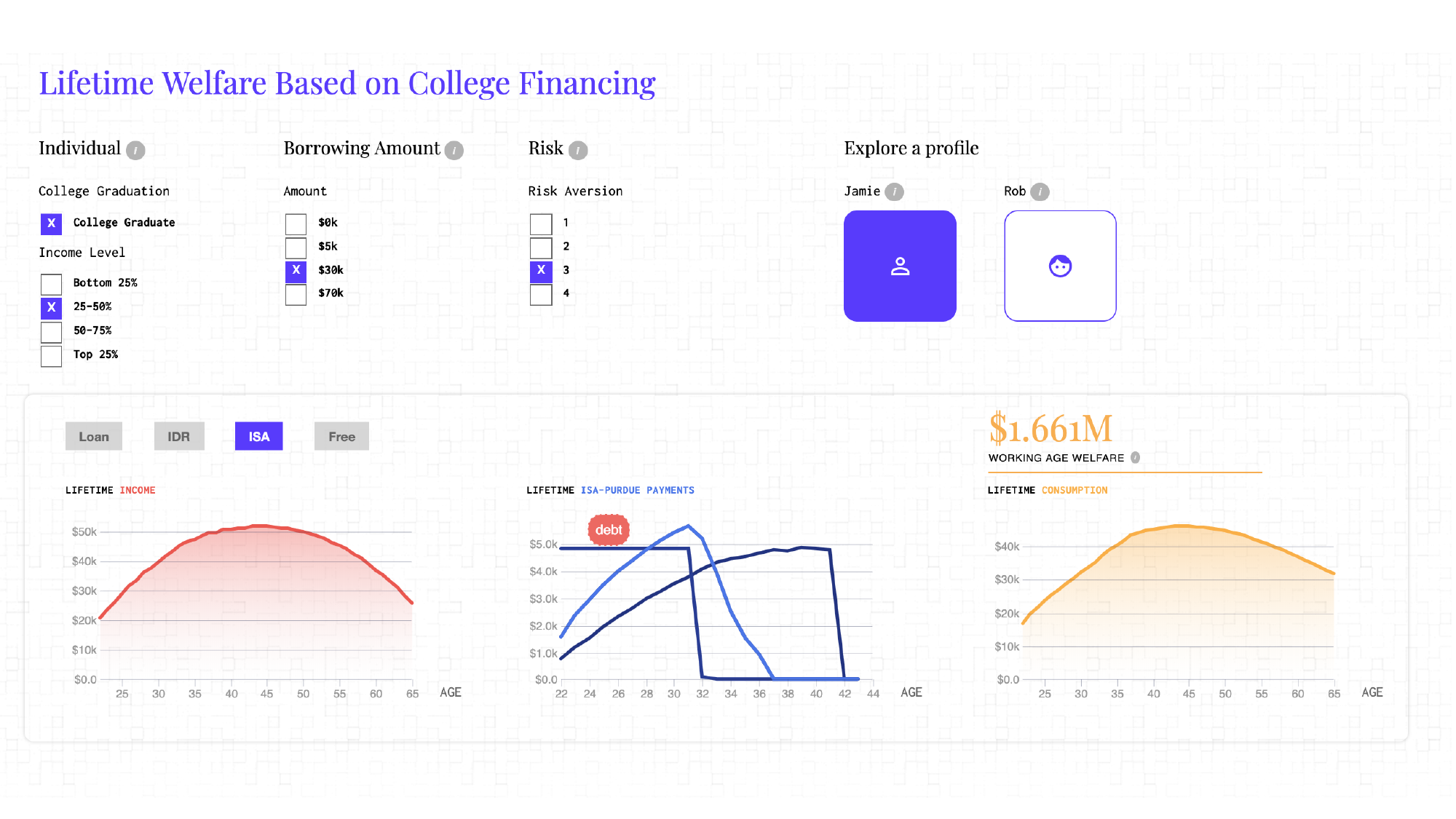

The dataset consists of both real and synthetic data generated from an internal model by Lead Researchers at the Jain Family Institute. The data shows annual income, payments and consumption (measure of welfare) for segmented profiles at every age between 22 to 100 (18 to 100 for high school graduates). Each profile has four series: 1) how much income, payment and consumption amounts would be if the average individual with that profile took out a loan; 2) how much those amounts would be if the average individual with that profile used an Income-driven Repayment Plans (IDR); and finally 3) amounts if the average individual with that profile used an Income Share Agreement. The data is preserved in this form, and ran through a script that prepares it for data visualization; extracting necessary data from all four series.

Primary Beneficiary of Income Share Agreements (ISAs)

The question is not so much "are Income Share Agreements better than loans?", but "When is an Income Share Agreement better than a loan?" Based on the data examples collected so far, an income share is the most beneficial for individuals in the bottom 25% of income earners. The more this type of individual needs to take out, and the more risk-adverse they are, the more an Income Share Agreement initiative can support their lifetime welfare. For this type of individual, using an ISA instead of taking out a loan can give them back around $20,000 during their working age years. To put it in perspective, it could spell the difference for a person being able to put a down payment on a house or not.

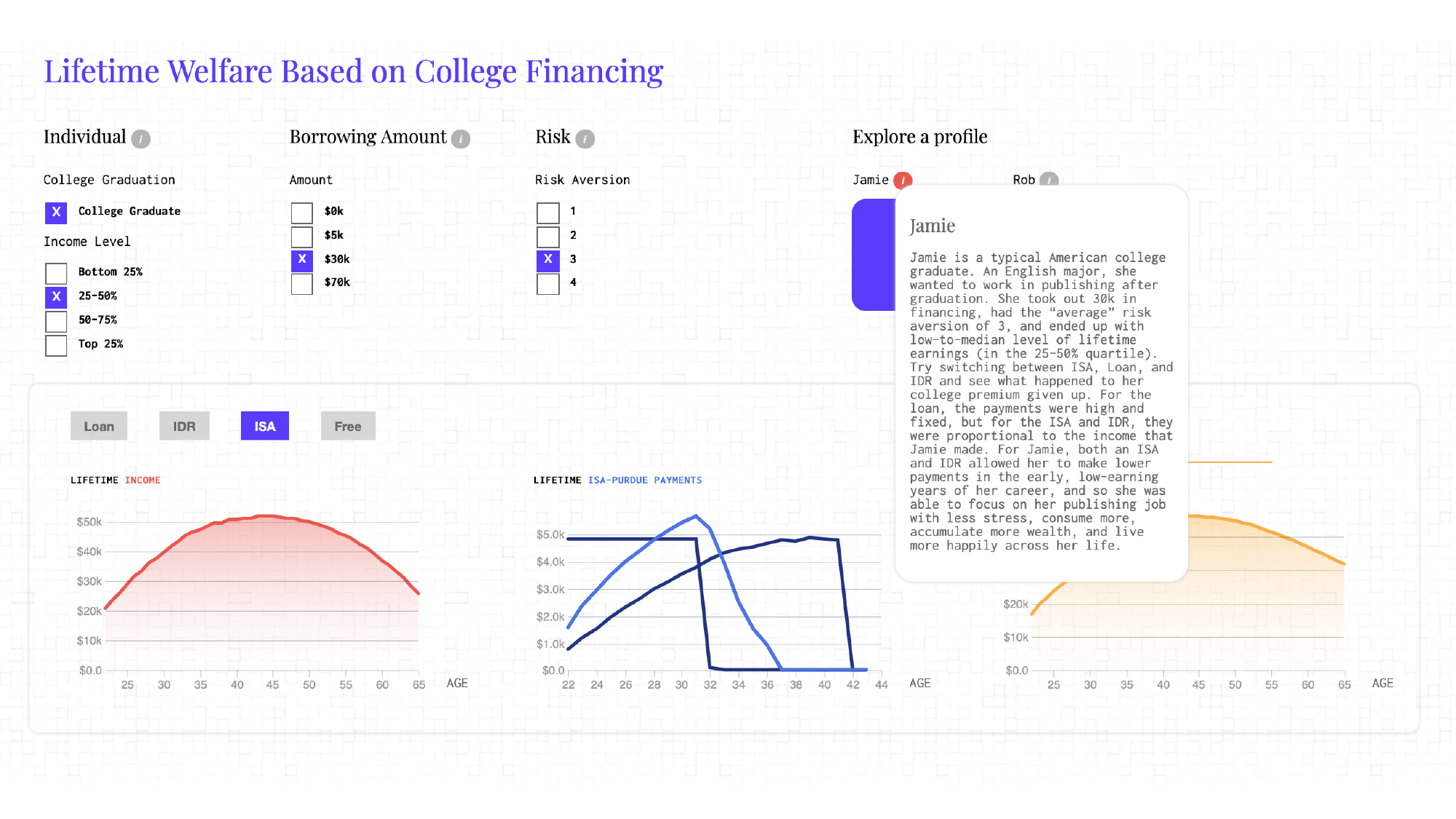

Secondary Beneficiaries of Income Share Agreements

Secondary beneficiaries of income share agreements are average income earners with the average amount of student debt (around $30,000). For these individuals, while their net lifetime consumption (welfare) does not change much between ISAs and Loans, using an ISA can help them smooth out their welfare curve between the ages of 25-30. By lowering and gradually increasing payments during that time, these individuals can have a little bit more cash in their pocket during their early career years.

Fellowship